We created 1102 Partners to serve our own family members.

We were soon asked to provide finance and investment guidance outside of our family. We made the decision to work with a select group of high net worth clients, providing them with the same exclusive service we give our own family.

David is a national-class age-group distance runner, competing at distances from 5k through the marathon

He was named Chicago Area Runners Association’s Senior Male Runner of the Year in 2022 and 2023

David Maley, CFP®

David is the Chief Investment Officer of 1102 Partners, which he co-founded with his wife Judy in 2021. He has 40 years of broad and deep investment experience, including 32 as a portfolio manager. David became a CFP® Professional in 2023.

He served ultra-high net worth families for 16 years at Harris Bank in Chicago, where his duties included managing a customized global equity portfolio designed to provide reliable and growing income streams. This experience continues to inform David’s management of 1102 Partners’ family and client portfolios, with a global Quality Dividend Growth Strategy often serving as the core equity portfolio in a diversified asset mix.

David later spent 12 years at Ariel Investments, where he led the firm’s efforts in micro-cap and small-cap deep value investing, bringing to the firm a strategy he launched in 2002 at Maple Hill Capital Management. 1102 Partners is now that strategy’s third home, with David as sole decision-maker at each stop. David also managed Ariel’s Domestic Trading Department and chaired the Trading Oversight Committee.

David started his career in Equity Sales and Trading at Goldman Sachs, where as a member of the Chicago Institutional Department he specialized in equity derivatives serving the Midwest’s largest banks, mutual funds, pension plans and hedge funds.

David joined Goldman Sachs after earning his MBA from the University of Chicago Booth School of Business, where he received a full merit scholarship after graduating from the University of Notre Dame with High Honors.

In addition to his duties at 1102 Partners, David is a former Director of ClearSign Technologies Corporation (CLIR). He is a member of the Finance Committee and Investment Committee of Thresholds in Chicago, as well as a Board Member of the Joseph Maley Foundation. David also served previously as a Mentor at the Chicago Booth Polsky Center for Entrepreneurship and Innovation.

A reformed tennis enthusiast, Judy is an avid pickleball player, a beginning golfer, and a fan of Mahjong

Judy loves theatre; it is rare to find a musical she has not enjoyed

Judy Maley

Judy leads Philanthropy along with Marketing and Strategy at 1102 Partners, which she co-founded with her husband David in 2021. She plays an integral role in the firm’s communication with clients and often within the families of the clients 1102 serves. Judy also has driven the firm’s strategy to expand from serving one family to other High Net Worth (HNW) individuals and families.

Judy brought a robust background in marketing, strategy and consulting to 1102 Partners having worked at Fortune 500 companies including Eli Lilly & Co., Baxter Laboratories, and Kitchens of Sara Lee. She also worked for Metropolitan Family Services where Judy was awarded the Volunteer Illinois Award for Outstanding Volunteer Administrator.

Most recently, Judy co-founded and co-directed The University of Chicago Booth Nonprofit Alumni Consultants (BANC), which brought together Booth alumni who performed $3 million in transformative pro bono consulting projects for Chicago area nonprofits during her tenure, and another $3 million since she departed for 1102 Partners. Judy has also consulted in philanthropy and leadership with a focus on nonprofit board service.

Judy serves on the Advisory Board of the Rustandy Center of Social Sector Innovation at Chicago Booth. She previously was a Board Member and Secretary at Thresholds. In addition, Judy served on the Advisory Board at After School Matters, among other nonprofit boards and service through more than 30 years of philanthropic experience.

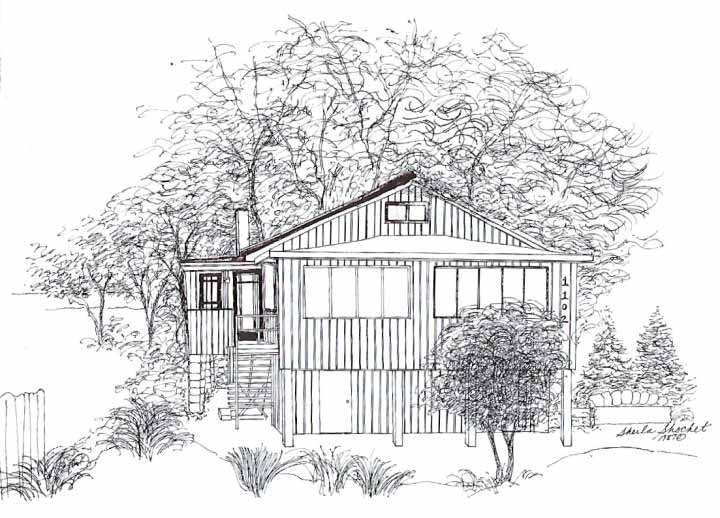

More than a century ago our great grandparents had a small cottage along the shores of Lake Michigan with the street number of 1102. Generation after generation of extended family gathered there. The tower you see in our logo is a landmark in the town, and to us, a symbol of home.

The love of family and the memories of this special place led to our company’s name. Now, we provide other families with the same financial expertise and sense of care as we do our own.

Our core values

We listen

We are fiduciaries – our clients always come first

We believe in transparency, simplicity, and expense minimization

We are a fee-only firm; we do not earn commissions on any investments

We collaborate with our clients and their attorneys, accountants, and other trusted advisors

We have 30+ years of philanthropic leadership

We are eager students of markets, financial planning, and behavioral economics

We give our clients the same high-level treatment we give our own family members

Cash Flow Analysis & Planning

Financial

Planning

Asset

Allocation

Investment

Management

Tax

Planning

Estate

Planning

Philanthropy

Family

Education

With a limited number of clients, we can give you the attention you deserve.

All of our clients enjoy the same high-level service, access, and focus as our own family members.

Our strategies and portfolios are highly customized.

Forget the templates and automated software – we make decisions specific to you, your situation, and your goals.

You shouldn’t have to wonder if you’ll have enough.

We want your investments to work for you – so that you can confidently live a life you love and leave a lasting legacy.

FAQs

Why work with a CFP® Professional?

Almost anyone can call themselves a financial planner. However, earning the CERTIFIED FINANCIAL PROFESSIONAL™ designation requires both extensive subject knowledge and maintenance of the highest ethical and fiduciary standards. David Maley, Our Chief Investment Officer, earned this designation in 2023 after decades in various investment roles. This curriculum provided an extremely comprehensive and valuable knowledge base to complement his investment expertise in his current role as a Family Office CIO.

Please visit letsmakeaplan.org to learn more.

How are you paid?

We are a fee-only firm. That means we do not earn commissions on any transactions we undertake on your behalf. We charge a percentage of Assets Under Management (AUM) which we believe to be lower than most of our competitors, and which decreases as your AUM reaches certain thresholds. Our full fee schedule is available upon request or can be found in our ADV.

Our fee includes investment management along with service as befits a Family Office client. We provide financial planning, cash flow analysis, retirement planning, equity management services, legacy planning, philanthropic advice, family financial education, insurance planning, as well as tax and estate planning in collaboration with your trusted advisors.

What is your investment philosophy?

We are patient, long-term investors who believe in transparency, simplicity, and expense and tax minimization. Diversification is a cornerstone of our highly personalized portfolio construction, designed to align with your risk tolerance and long-term objectives.

The core equity portfolio for most clients is our proprietary Quality Dividend Growth strategy. We build around that by using low cost Exchange Traded Funds (ETF’s) and/or mutual funds to gain exposure to other asset classes and sub-asset classes. We also use individual securities in fixed income portfolios when desirable.

For our Special Situations Micro-Cap strategy, we employ a long-term deep value approach. Most of our Family Office clients do not utilize this strategy; most investors in the portfolio hire us specifically for this purpose.

Is the initial meeting free?

Yes, and if we both see a potential fit after that meeting, we will present a proposal including a detailed preliminary plan free of charge in a second meeting. This proposal will be based on your current financial situation and our initial understanding of your risk tolerance and goals for your lifetime and legacy. If we then decide to work together, we will refine that plan as we dive deeper into your finances and objectives. We will then draft a comprehensive Investment Policy and Strategy Statement designed to guide our actions going forward.

I have private equity and other non-publicly traded assets. How does that work?

Most of our clients have some investments outside of 1102’s investment responsibility. We take these into account as we analyze your risk profile and manage your portfolio. We often communicate with those managing these outside assets, as we seek to fully integrate them into your plan. There is no additional fee for 1102 Partners to monitor these or to include them in our portfolio analysis.

Where will my assets be held?

Our clients have their assets custodied at Charles Schwab & Co., where we operate on the Schwab Advisor Platform. We work with you to make the transition as seamless as possible. This arrangement provides an extra layer of security and transparency for you, as only you have the ability to move assets or cash from your accounts. You will have the ability to access your Schwab accounts online at any time and will receive regular statements and transaction confirmations from them.

Can you help me with starting a family foundation or meeting other philanthropic goals?

Yes. Philanthropy is often a big part of our clients’ legacy plans. Judy Maley has over 30 years of experience in the world of philanthropy, nonprofits, and social enterprise which we bring to bear in helping you create a plan for impactful giving. We can help you create a family foundation, including the administrative steps, drafting a mission statement, and managing the foundation’s assets. We can also advise you on using a Donor Advised Fund (DAF), making ala carte donations, and creating a legacy giving plan.

Are you ready to get started?

Fill out this short form, and we’ll reach out to schedule your free discovery meeting to learn more about working with 1102 and see if we’re a good fit for your needs.

(Our best-match clients have at least $5M in investible assets.)

Based in Chicago • Serving clients nationwide